Anticipation grows for potential supply increase, but challenges remain.

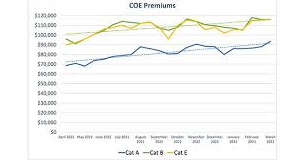

INGAPORE: Certificate of entitlement (COE) premiums have seen a significant rise throughout 2022, reaching record highs in four out of five categories, including larger and more powerful cars, commercial vehicles, motorcycles, and the Open category. The only exception was the category for cars with less power, which fell short by just $1,511, or 1.6%, of the record $92,100 set in January 2013.

Looking ahead, consumers may find some relief in the latter half of 2023 as vehicle population data suggests a potential increase in COE supply. Mr. Ron Lim, head of sales at Nissan agent Tan Chong Motor, forecasts that COE supply could begin to improve from August, although it may not be until November 2023 that significant changes are felt. Similarly, Mr. Nicholas Wong, general manager of Kah Motor, anticipates a rise in COE availability from June, spurred by an uptick in vehicle deregistrations.

However, the start of 2023 is expected to echo the high premiums of 2022 due to ongoing low COE supply, primarily influenced by the number of vehicles being decommissioned. Transport Minister S Iswaran noted that demand for vehicles has remained strong despite the restrictive supply.

The two categories of car COEs are differentiated by engine size and power output. In a bid to promote electric vehicle (EV) adoption, a criterion specific to EVs was introduced in May. This change moved EVs with up to 110 kilowatts of power into the traditionally cheaper Category A, where the power limit for non-EVs is 130 bhp or 97 kW. This adjustment has contributed to an increase in Category A COE prices, as EV buyers benefit from a $25,000 rebate under the Enhanced Vehicular Emissions Scheme.

Comparing the premiums from the first and last tender exercises of 2022, the price gap between Category A (typically cheaper) and Category B (larger and more powerful cars) has narrowed from 34% to 22.7%. Category B prices reached a staggering $115,388 during the first tender in November, with Open category COEs hitting a new high of $116,577.

The motorcycle COE category also experienced record highs, with premiums peaking at $13,189 in November—over 7.8 times the peak of $1,701 seen in 2010, when supply was critically low. Despite measures implemented in March to address surging premiums, demand for motorcycle COEs remains strong, partly fueled by the rise of food delivery services.

Commercial vehicle COE prices nearly doubled in 2022, beginning the year at $42,200 and soaring to $81,802 in the second tender in November. This was due to a significant decrease in the supply of commercial vehicle COEs, which fell to 2,092 from 4,537 in 2021.

For 2023, projections indicate that COE supply will remain low overall, with premiums expected to stay elevated at least through the first half of the year. Data indicates that 25,636 vehicles are nearing their 10th anniversary, while another 29,349 will reach their 15th year by January 2022. Vehicles that do not have their COEs revalidated upon reaching 10 years—along with those that are 15 years old and have undergone only five-year revalidations—will need to be deregistered, impacting the COE supply.

As January approaches, it’s expected that registrations could reflect orders that dealers have postponed, and the return of the Singapore Motorshow may further stimulate COE prices. However, Mr. Lim from Tan Chong Motor urges caution regarding broader economic conditions, noting that any potential recession could lead to earlier-than-expected declines in COE premiums.