New Resource Offers Practical Advice on Saving, Insurance, and Investing for All Stages of Life

SINGAPORE: The Monetary Authority of Singapore (MAS) launched a new Basic Financial Planning Guide on October 7, aimed at helping Singaporeans manage their finances more effectively. Developed in collaboration with the Association of Banks in Singapore (ABS), the Association of Financial Advisers (Singapore) (AFAS), and the Life Insurance Association (LIA), the guide is designed to offer straightforward advice on savings, insurance, and investing.

The guide comes in response to a 2021 MoneySense survey, which revealed that many Singaporeans do not have a retirement savings plan. According to MAS, the guide provides actionable steps that can help improve the financial well-being of individuals throughout various stages of life.

Key Advice in the Financial Planning Guide

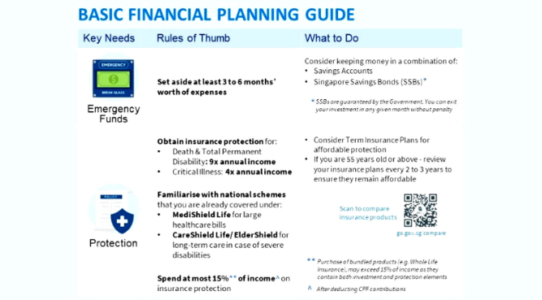

Emergency Fund: Set aside enough savings to cover three to six months’ worth of living expenses to cushion against unexpected costs.

Insurance: Ensure you have insurance equal to nine times your annual income to cover periods of illness or injury, and four times your income for critical illnesses. It is recommended that no more than 15% of your income be spent on insurance.

Investing: Allocate at least 10% of your income toward investments such as stocks or savings, as this will be crucial for long-term financial security.

Starting in January 2024, the guide will be tailored to various life stages, including those just beginning their careers, parents with young children, caregivers for elderly family members, and individuals approaching retirement.

Industry Support and Encouragement

MAS’ Mr. Lim Tuang Lee, who is also a member of the MoneySense Council, expressed gratitude to the industry groups for their collaboration in producing the guide. He emphasized that the guide offers simple and practical steps that can help enhance the financial well-being of Singaporeans.

ABS’ Mrs. Ong-Ang Ai Boon highlighted the importance of financial literacy programs, encouraging people to engage with their banks for personalized advice and guidance.

AFAS President, Mr. Raymond Ng, praised the user-friendly nature of the guide, noting that AFAS is committed to using it in their interactions with consumers and facilitating comprehensive financial planning discussions.

LIA President, Mr. Dennis Tan, expressed confidence that the partnership would assist Singaporeans in preparing for various life stages and unforeseen events, reiterating the importance of financial planning.