Mixed performance across banking stocks and global markets contributes to the dip.

SINGAPORE: Singapore shares dipped on Wednesday morning, Feb 28, following a mixed performance across global markets.

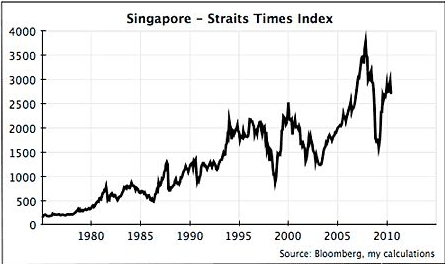

The Straits Times Index (STI) fell by 0.3%, losing 9.23 points to reach 3,148.09 as of 9:01 am local time, according to The Business Times.

In the broader market, 53 stocks gained, while 48 declined. The total turnover amounted to S$63.8 million, with 56.6 million securities changing hands.

Seatrium saw the highest trading activity, increasing by 2.22%. Despite trading 11 million securities, its price remained steady at S$0.09.

Notable performers included Yangzijiang Shipbuilding, which rose 0.6%, gaining S$0.01 to reach S$1.68, and Thomson Medical, which increased by 3.9%, reaching S$0.054.

Banking stocks showed mixed trends in the morning session. DBS saw a slight decline of 0.2%, dropping S$0.05 to S$33.45. OCBC experienced a 2% decrease, down S$0.26 to S$13.05. However, UOB posted a marginal increase of 0.04%, rising by S$0.01 to S$28.21.

Before the market opened, OCBC announced its fourth-quarter 2023 net profit, which rose by 12% to S$1.62 billion, compared to S$1.44 billion the previous year.

Across the pond, the US stock market concluded with a mixed performance on Tuesday, influenced by disappointing consumer confidence and durable goods data. The Dow Jones Industrial Average fell by 0.3% to 38,972.41.

Meanwhile, the S&P 500 gained 0.2%, reaching 5,078.18, and the Nasdaq Composite Index saw a 0.4% increase, closing at 16,035.30.

In Europe, the Stoxx 600 saw a slight rise on Tuesday, with Germany’s DAX achieving a record high.

Investors are closely watching this week’s inflation data, which may provide insights into potential interest rate adjustments later in the year. The pan-European Stoxx 600 closed 0.2% higher, at 496.33.