Equity funds see the highest outflows, while CPFIS funds perform better in Q4

SINGAPORE: Singapore’s unit trusts reported S$998 million in net outflows in the fourth quarter of 2023, marking a sharp contrast to the S$264 million in net inflows seen in the previous quarter, according to Morningstar’s latest Singapore Fund Flow report.

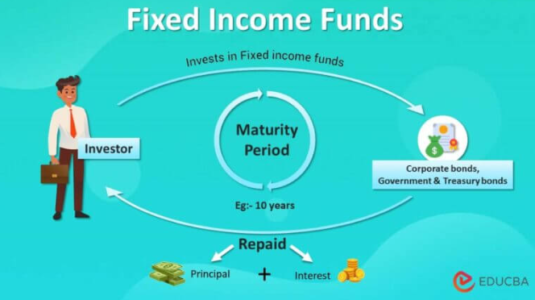

Equity funds bore the brunt of the outflows, with S$432 million pulled out during the period. Fixed-income assets also faced significant withdrawals, recording a net outflow of S$204 million. Money market funds saw a net outflow of S$150 million, while allocation and alternative funds experienced outflows of S$195 million and S$16 million, respectively.

On the other hand, commodities posted a relatively mild net outflow of S$1.54 million, while convertibles were an outlier, showing a modest net inflow of S$20,000.

Despite the overall trend of outflows, unit trusts under the Central Provident Fund Investment Scheme (CPFIS) demonstrated strong performance. The fourth quarter saw returns rise to 3.77%, recovering from a negative return of 2.28% in the previous quarter.

For the full year of 2023, CPFIS funds posted an average return of 7.88%, with equity funds leading the way at 9.26%. Fixed-income and allocation funds followed with average returns of 4.67% and 6.4%, respectively.

Morningstar remains cautiously optimistic for 2024, though it notes key risks including moderate valuations, a softening economy, weakening fundamentals, and potential external shocks.